Do you ever ask yourself why do royalty checks fluctuate in value? You’re not alone! A lot of mineral owners wonder why their royalty checks change so much from month to month. There are a lot of reasons your royalty checks can change in value, but we can help you figure out why. If you have questions about your royalty checks, you can fill out the form at the bottom of this page and we can help answer your questions.

Factors affecting oil royalty checks value

If your royalty checks are changing in value every month, the reasons listed below can all contribute to the changing value. As a mineral owner, it’s frustrating to feel helpless when your mineral rights are changing in value. Here are some of the reasons your royalty checks will change in value:

- Oil & Gas Prices: Since the amount of your royalties is directly tied to oil and gas prices, if the price of oil and gas changes your royalty checks will change as well. This could mean more money for you if prices are going up, or it could mean less if prices are declining. We recently wrote about how lower oil prices are affecting mineral owners.

- Production Change: While oil and gas wells can be very consistent, some wells simply produce an inconsistent amount over time. One month the production could be very high and the next much less. The bulk of your royalty is determine by the amount of production times current price. When either of these factors changes, it will have a large impact on your royalties.

- Accounting / Deductions: Depending on how your lease was written, an oil and gas company may be allowed to deduct expenses from your royalties before making the payment. These expenses relate to operating costs the operator incurs. Your monthly check can be reduced by these expenses. In some cases, a large accounting adjustment will move a large amount of expenses to your well in a given month. This can reduce the amount you receive substantially.

- Well Decline: Every well naturally declines slightly over time. Even if a well produces consistently, it will gradually decline until it’s uneconomical to continue operating the well.

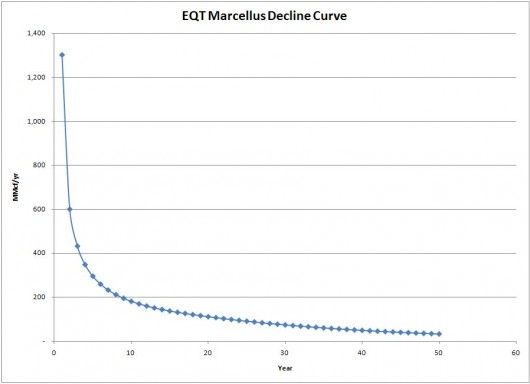

- New Wells: If you just started receiving royalty income, the amount you receive in the beginning is significantly higher. The reason is that a new well will produce a large amount of oil and/or gas for the first 3 to 5 years. During that time, it will produce large amounts but also decline very quickly until it finally settles. Check out the chart below and you can see how it drops off very quickly over the first 5 years.

Selling Royalties

If you rely on your oil royalties every month, you may consider selling royalties if your checks are changing a lot each month. The benefit of selling your royalties is that you will get a lump sum payment for the value of your royalties over the next 4 years to 6 years. Rather than getting inconsistent checks each month, you can get one guaranteed amount right now. Many mineral owners in retirement choose to sell royalties so they know exactly how much they will get. We have written extensive articles about the value of royalties and we advise you to check those out as well.

If you are considering selling royalties, we recommend that you list them with US Mineral Exchange. They will help you get your property in front of thousands of buyers who will compete to make you the highest possible offer for your royalties.

Free Consultation

If you own mineral rights and have questions, fill out the free consultation form below. We can help you with the following questions:

- Mineral Rights Value

- Evaluate whether you have a fair offer to sell mineral rights

- Answer questions about selling mineral rights

- Understanding Market Value of Mineral Rights

- + Any other questions related to mineral rights!

No matter what question you have regarding your mineral rights, we can help! We usually respond to your inquiry within 1 to 2 hours!

Whether you want to sell mineral rights, determine mineral rights value, or simply have some basic questions regarding your mineral rights ownership, fill out the form and we will quickly be in touch.